Introduction

🏢 Merchant Onboarding Guide

Welcome to the merchant onboarding experience. Follow these steps to configure your business, set up payment methods, and gain access to your financial ecosystem.

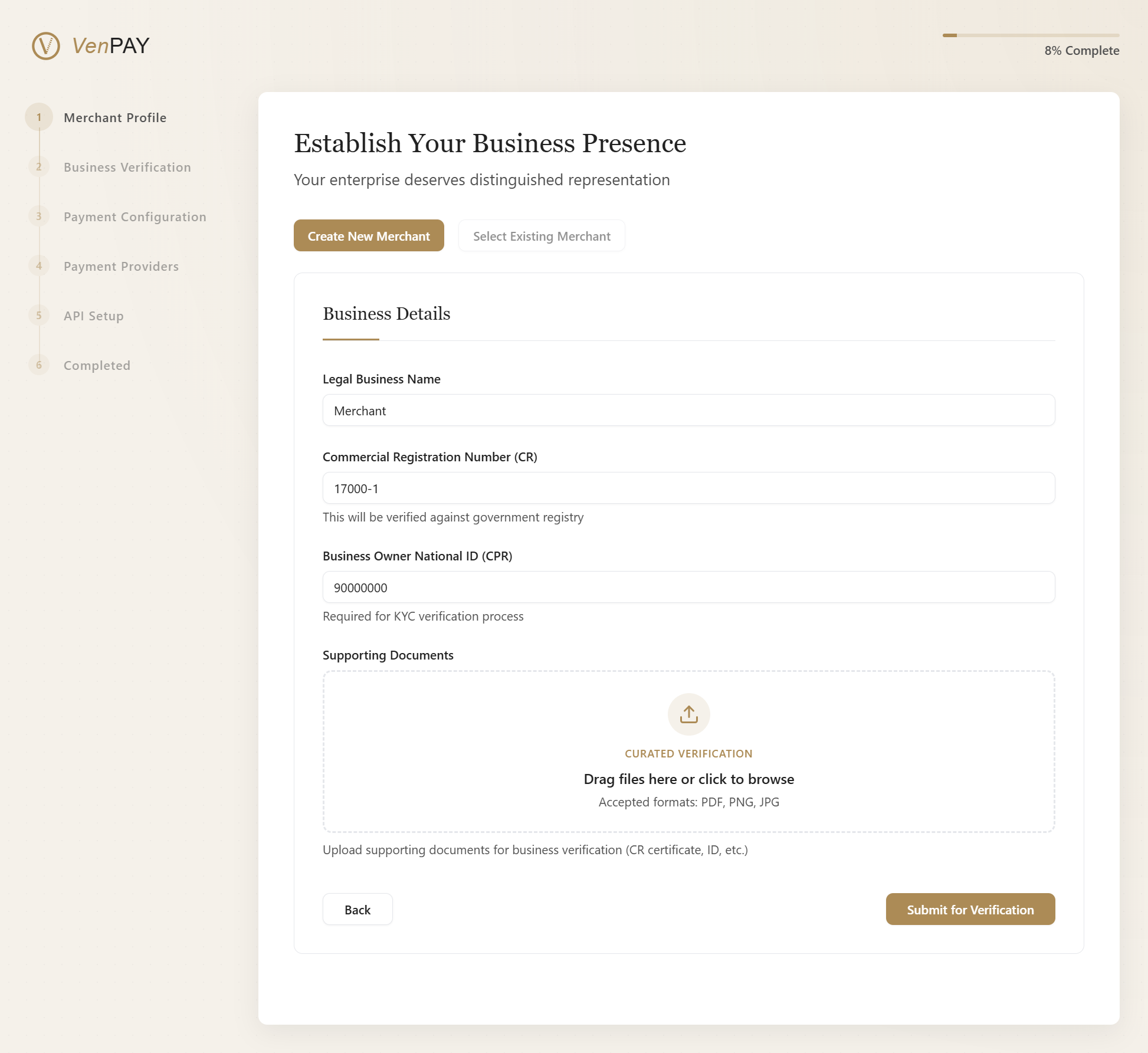

✅ Step 1: Establish Your Business Presence

Your enterprise deserves distinguished representation.

Choose an Option:

- 🔲 Create New Merchant

- 🔲 Select Existing Merchant

📋 Business Details

Provide the following verified information:

| Field | Description |

|---|---|

| Official registered business name | Must match government records |

| Government-issued business identifier | Will be verified against registry |

| Business owner's national ID number | Required for KYC verification |

📁 CURATED VERIFICATION

Drag files here or click to browse

Accepted formats: PDF, PNG, JPG

Examples: Certificate of Registration (CR), National ID, Tax Documents

Upload supporting documents for business verification.

📎 Example: Business License, Passport Copy, Tax ID Certificate

Upload your official documents to verify your business identity

Upload your official documents to verify your business identity

✅ Step 2: Selected Merchant: config

🔧 Change

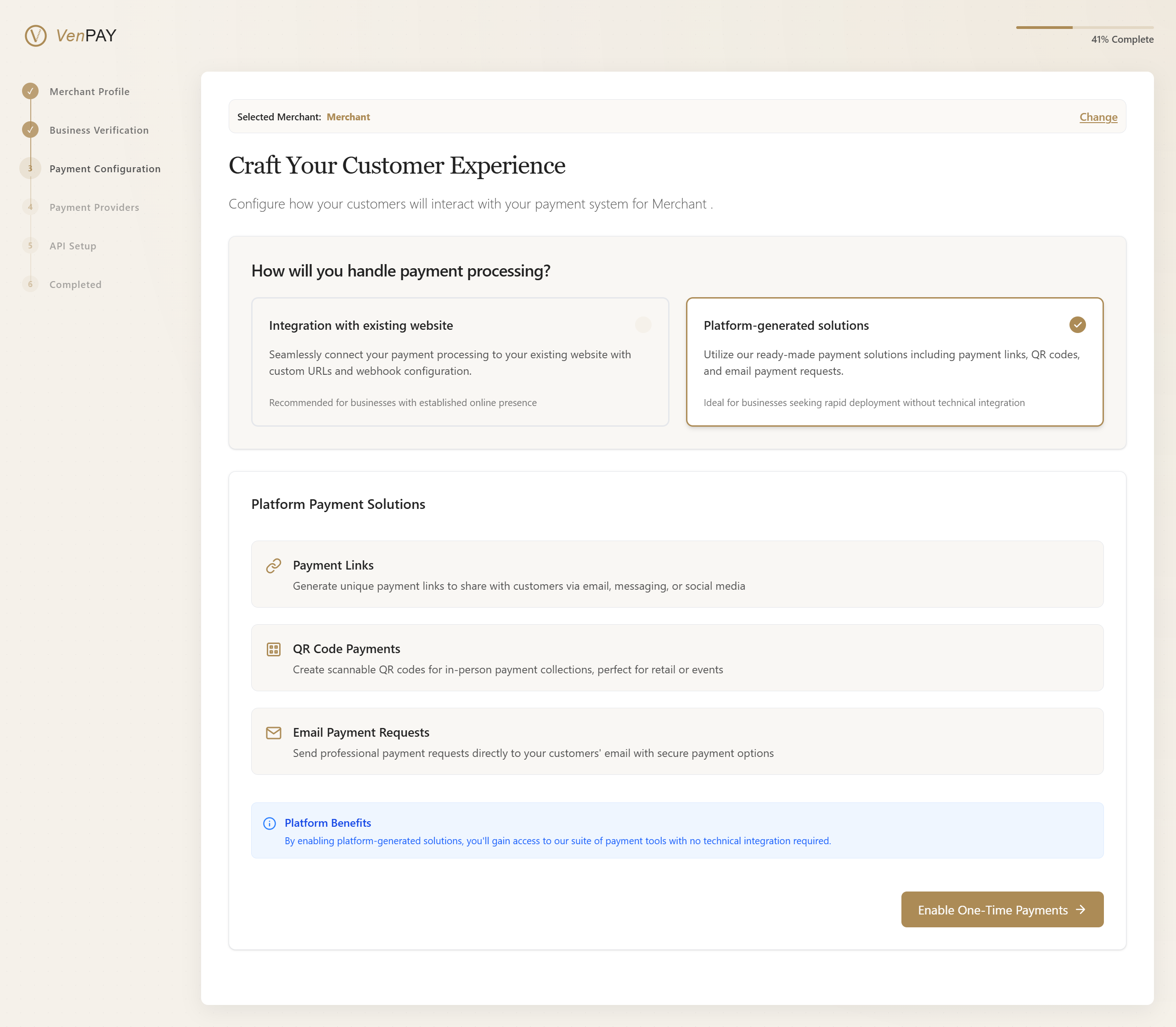

🎨 Craft Your Customer Experience

Configure how your customers will interact with your payment system.

Choose one of the following options based on your business needs:

🌐 Option A: Integrate with Existing Website

Seamlessly connect your payment processing to your existing website with custom URLs and webhook configuration.

Recommended for: Businesses with an established online presence

Integration Details

- Set up custom success/failure redirect URLs

- Configure webhooks for real-time payment updates

- Use SDKs or API calls to initialize payments

// Initialize payment with your API key

const vpay = new VPay('a718adcgb48');

// Create a payment session

vpay.createSession({

amount: 100.00,

currency: 'USD',

description: 'Premium Plan Subscription',

customerEmail: 'customer@example.com',

successUrl: 'https://your-website.com/success ',

failureUrl: 'https://your-website.com/failure '

})

.then(response => window.location = response.checkoutUrl)

.catch(error => console.error('Payment initialization failed:', error));

🧩 Option B: Platform-Generated Solutions

Utilize our ready-made payment tools with no technical integration required.

Ideal for: Businesses seeking rapid deployment without development overhead

Available Tools

- 💬 Payment Links: Generate unique payment links to share via email, messaging, or social media

- 📷 QR Code Payments: Create scannable QR codes for in-person collections (perfect for retail or events)

- 📧 Email Payment Requests: Send professional payment requests directly to your customers' inbox

Platform Benefits

By enabling platform-generated solutions, you gain access to:

- Instant payment page generation

- Pre-built UI for secure checkout

- Built-in analytics and tracking

Quick setup using VPAY’s built-in payment tools

Quick setup using VPAY’s built-in payment tools

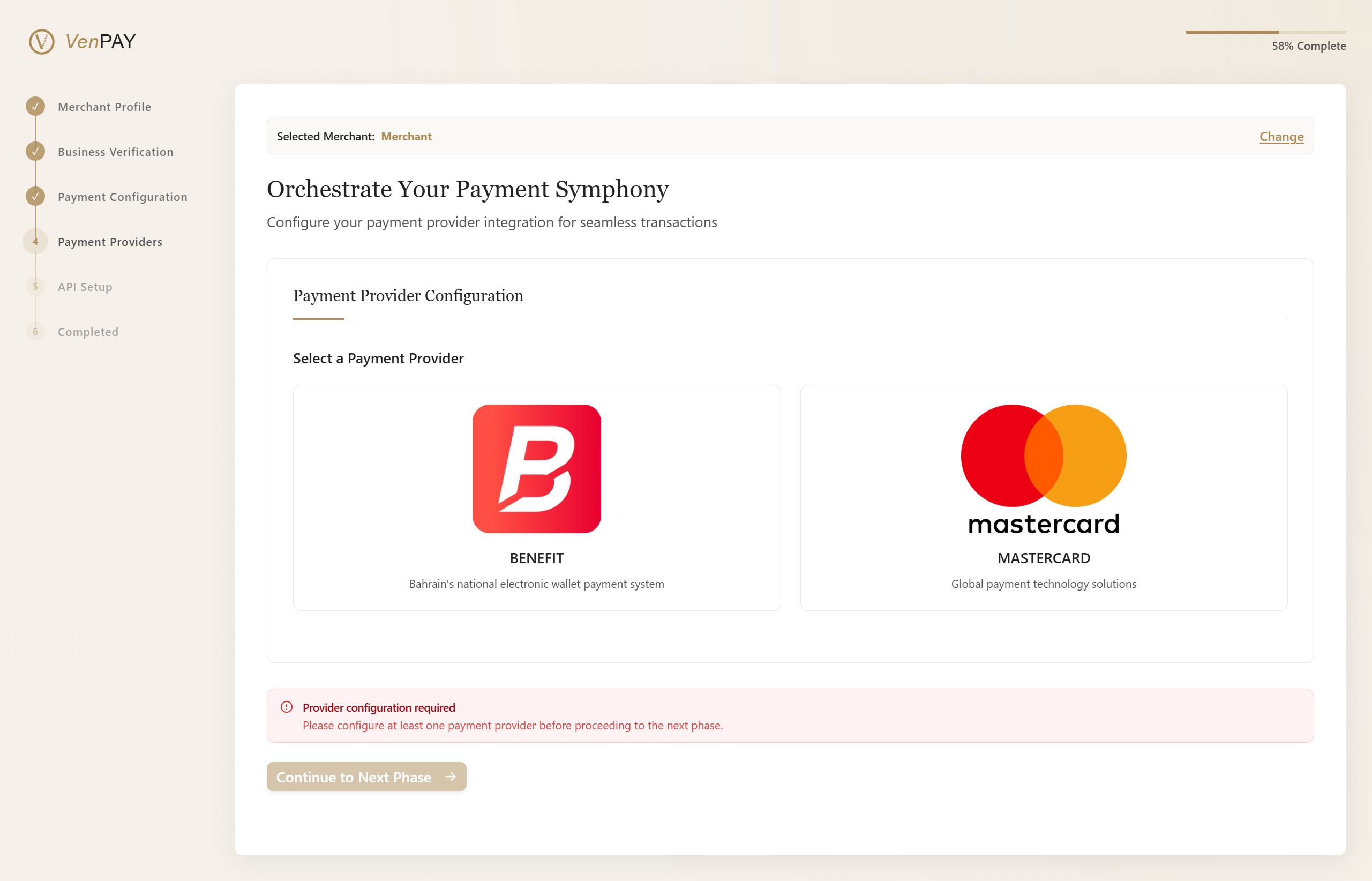

🔧 Step 3: Select a Payment Provider

Choose your preferred payment gateway to enable seamless transactions.

This step determines how payments will be processed and settled into your account.

🧭 Choose Your Payment Gateway

You can integrate with one of the following global payment providers:

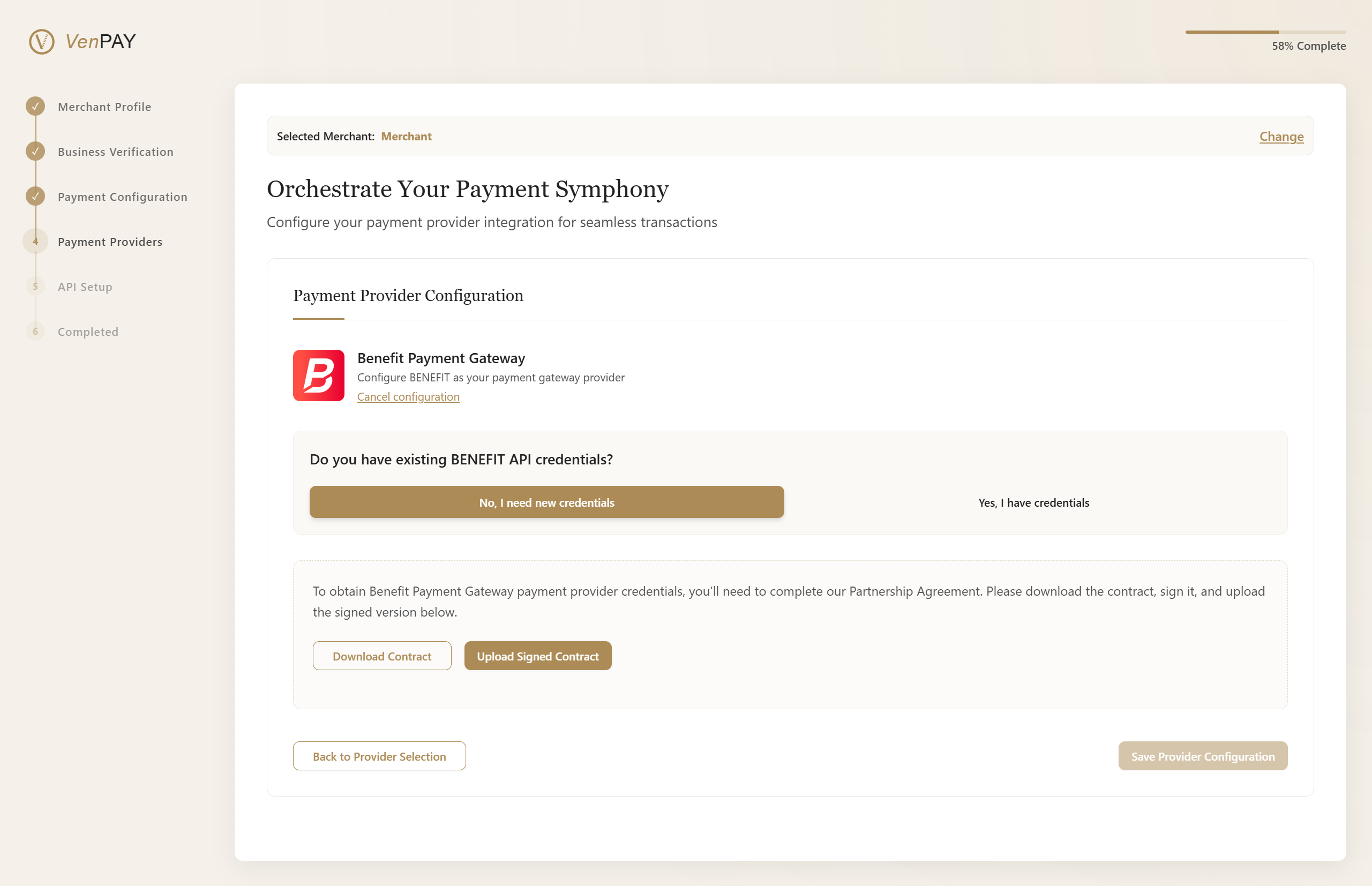

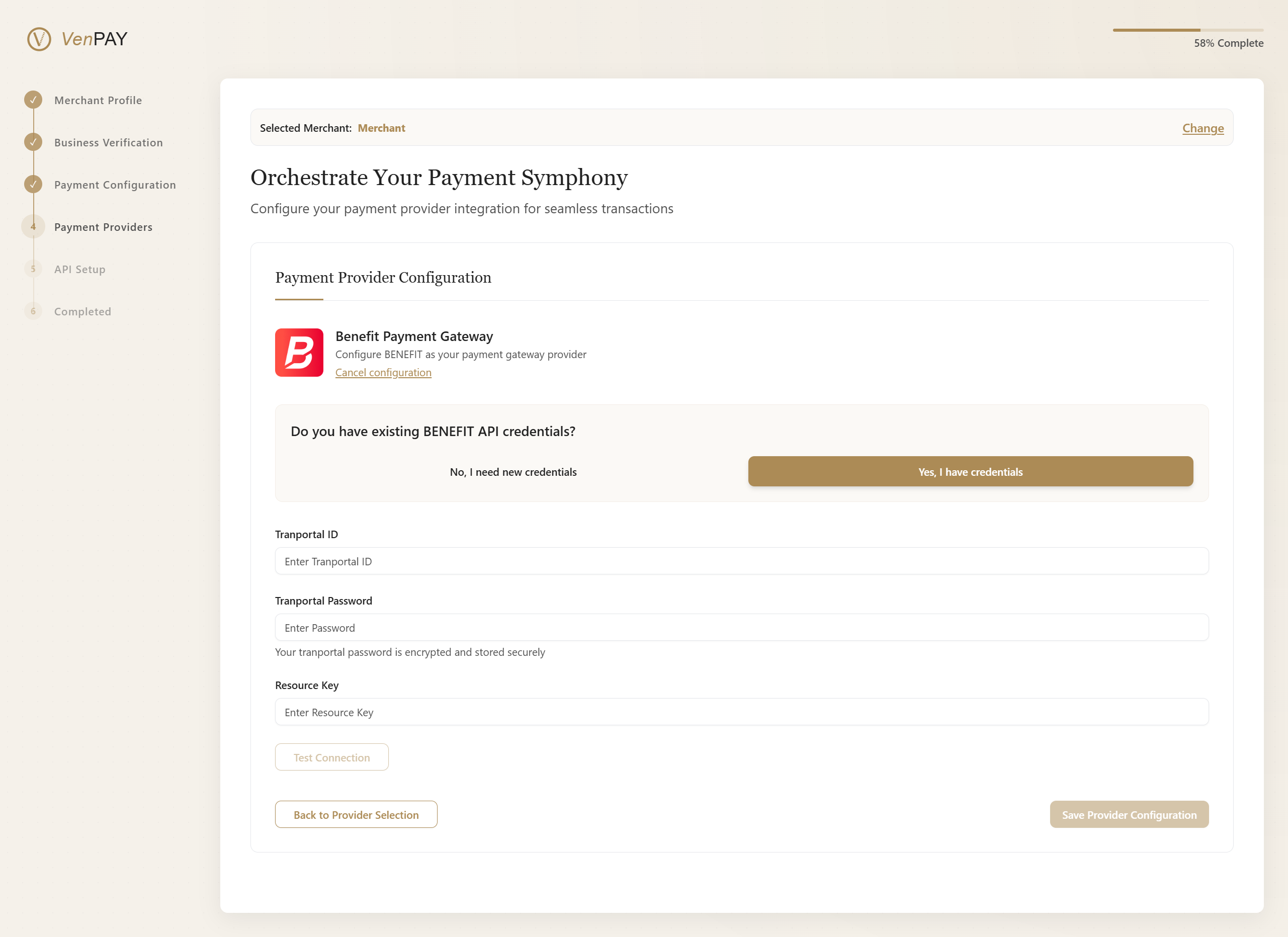

💳 Option A: Benefit Payment Gateway

BENEFIT – Bahrain's national electronic wallet payment system

Select a payment provider to begin configuration

🔐 Benefit Integration Setup

Do you already have credentials?

🔲 I'm setting up a new integration

Generate new credentials via the BENEFIT portal- Follow on-screen instructions to register your merchant

- Generate your:

- TranPortal ID

- TranPortal Password

- Resource Key

🔲 I already have existing credentials

Enter your current credentials below:- TranPortal ID

- TranPortal Password

- Resource Key

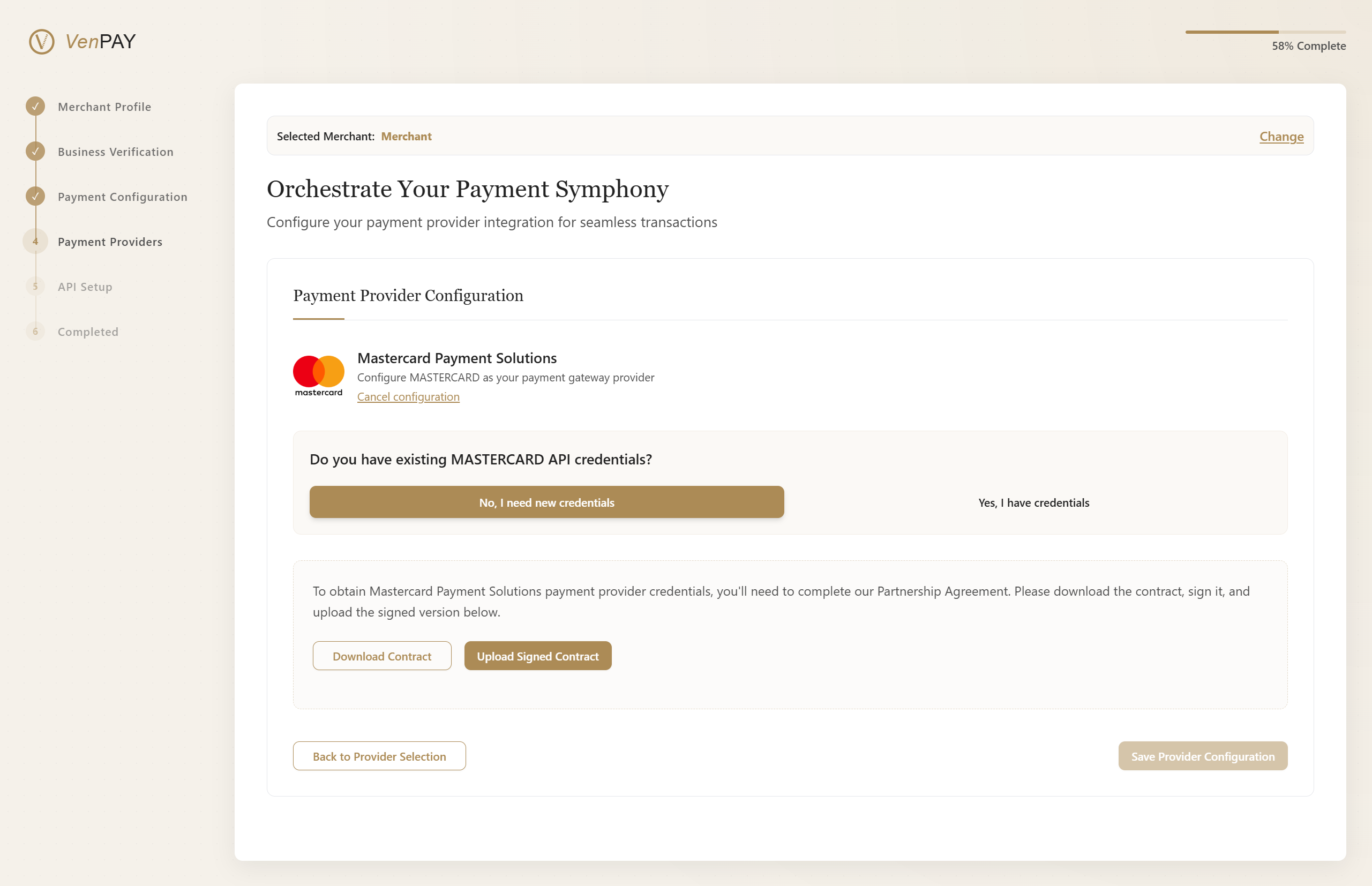

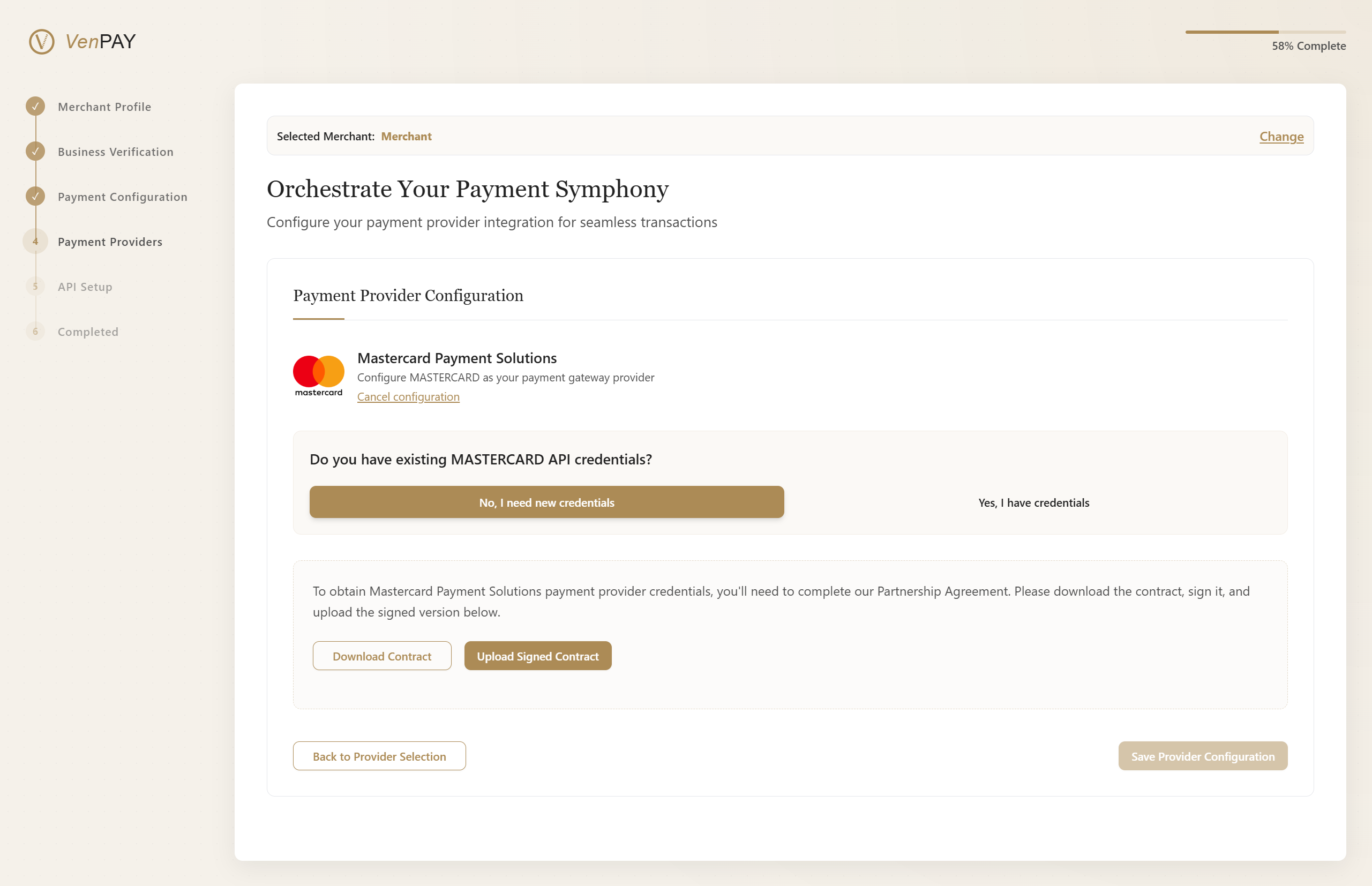

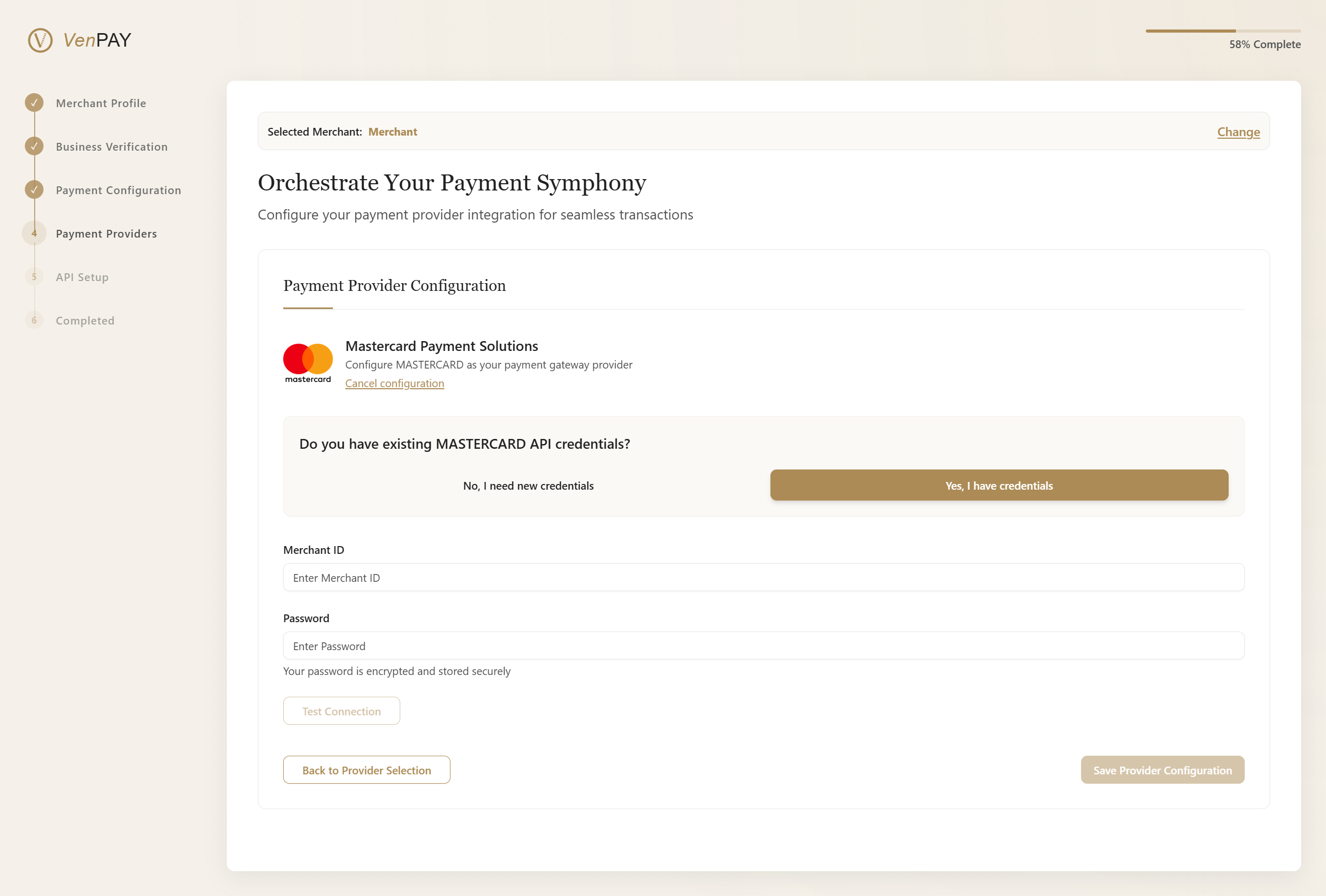

💼 Option B: Mastercard Payment Solutions

MASTERCARD – Global payment technology solutions

Begin setup for Mastercard integration

🔒 Mastercard Integration Setup

Do you already have credentials?

🔲 I'm setting up a new integration

Follow instructions to generate new API keys and merchant credentials🔲 I already have existing credentials

Enter your current credentials below:- Merchant ID

- Password

✅ Next Step

Once you've configured your payment provider, click Continue to proceed to the next phase of onboarding.

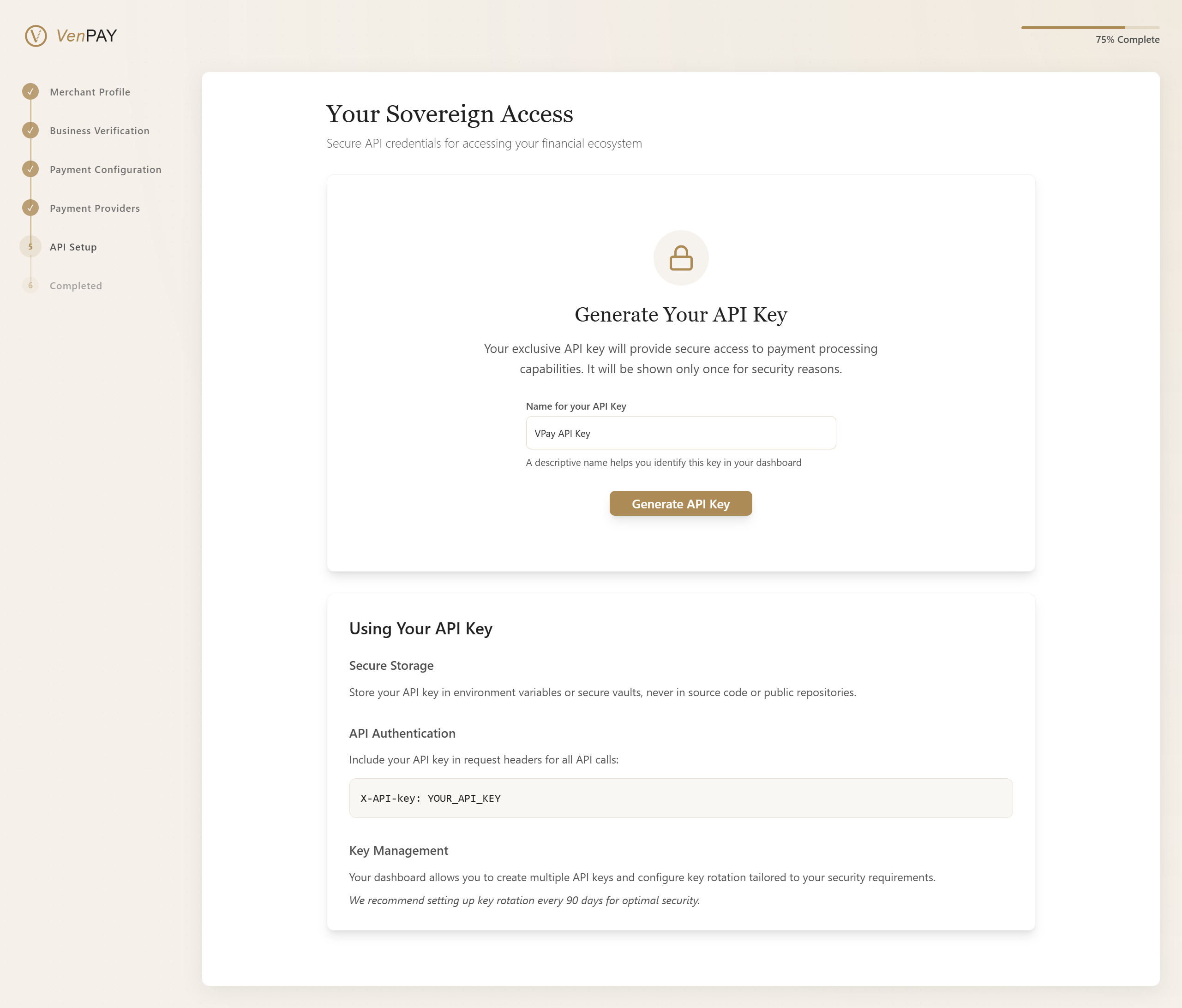

🔐 Step 4: Secure Your API Credentials

Your merchant account has been successfully configured. Now it's time to generate your API credentials, which will allow your system to securely communicate with VPAY services.

⚠️ Important: This API key will be shown only once. If lost, it cannot be recovered.

🧩 Generate Your API Key

Before generating your key, review your configuration to ensure all previous steps have been completed successfully.

Review your settings before proceeding to generate the API key

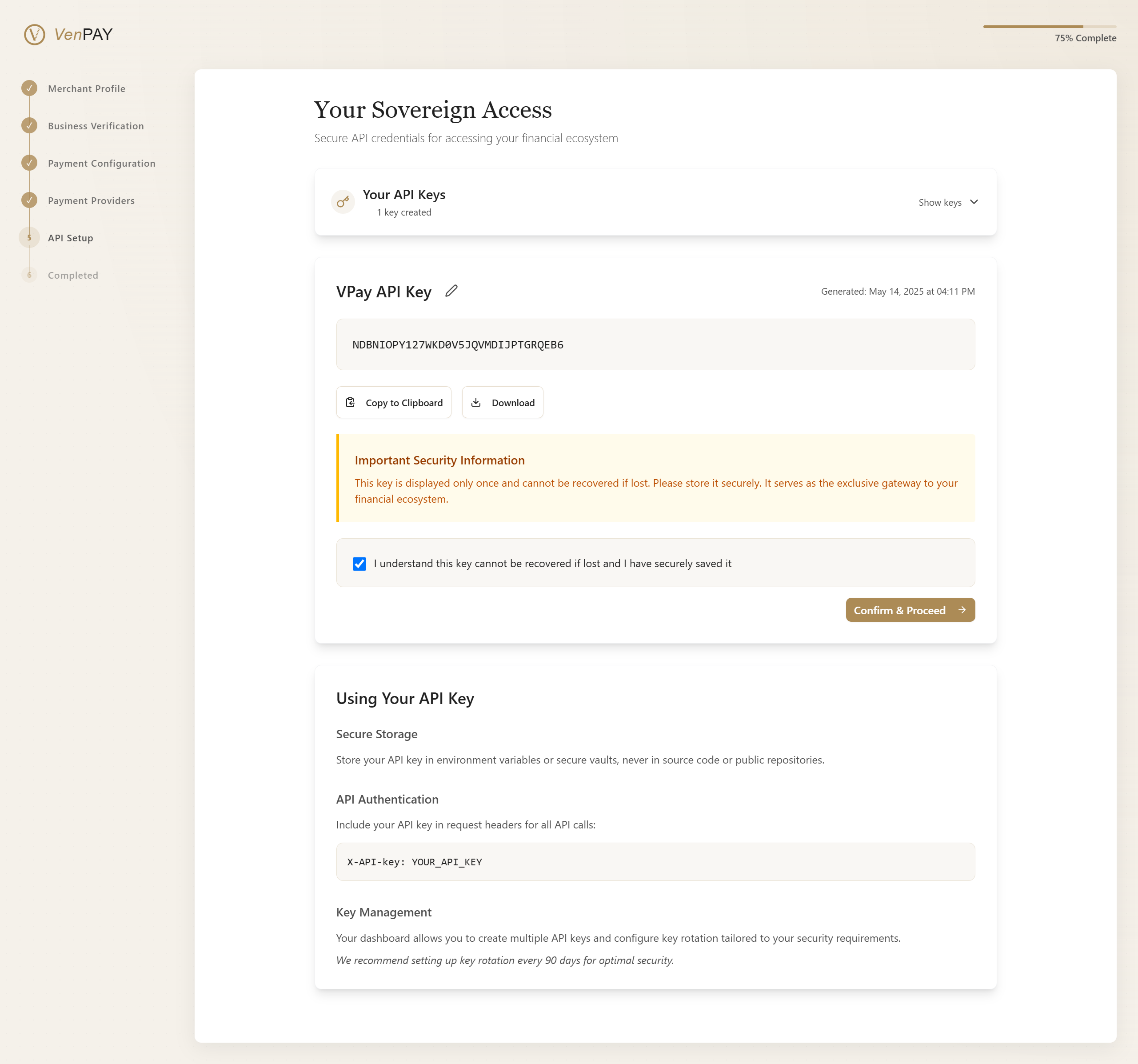

🔑 Generate & View Your API Key

Click Generate API Key to create your unique access token.

Once generated, you will see a screen like this:

Securely store your API key — it will not be shown again

🛡️ Important Security Instructions

🔒 Store It Safely

- Save the key in an encrypted secrets manager or environment variables.

- Never commit it to version control (e.g., Git).

- Avoid sharing it publicly or storing in client-side code.

📡 Use It Correctly

Include your API key in request headers for all API calls:

X-API-Key: YOUR_API_KEY

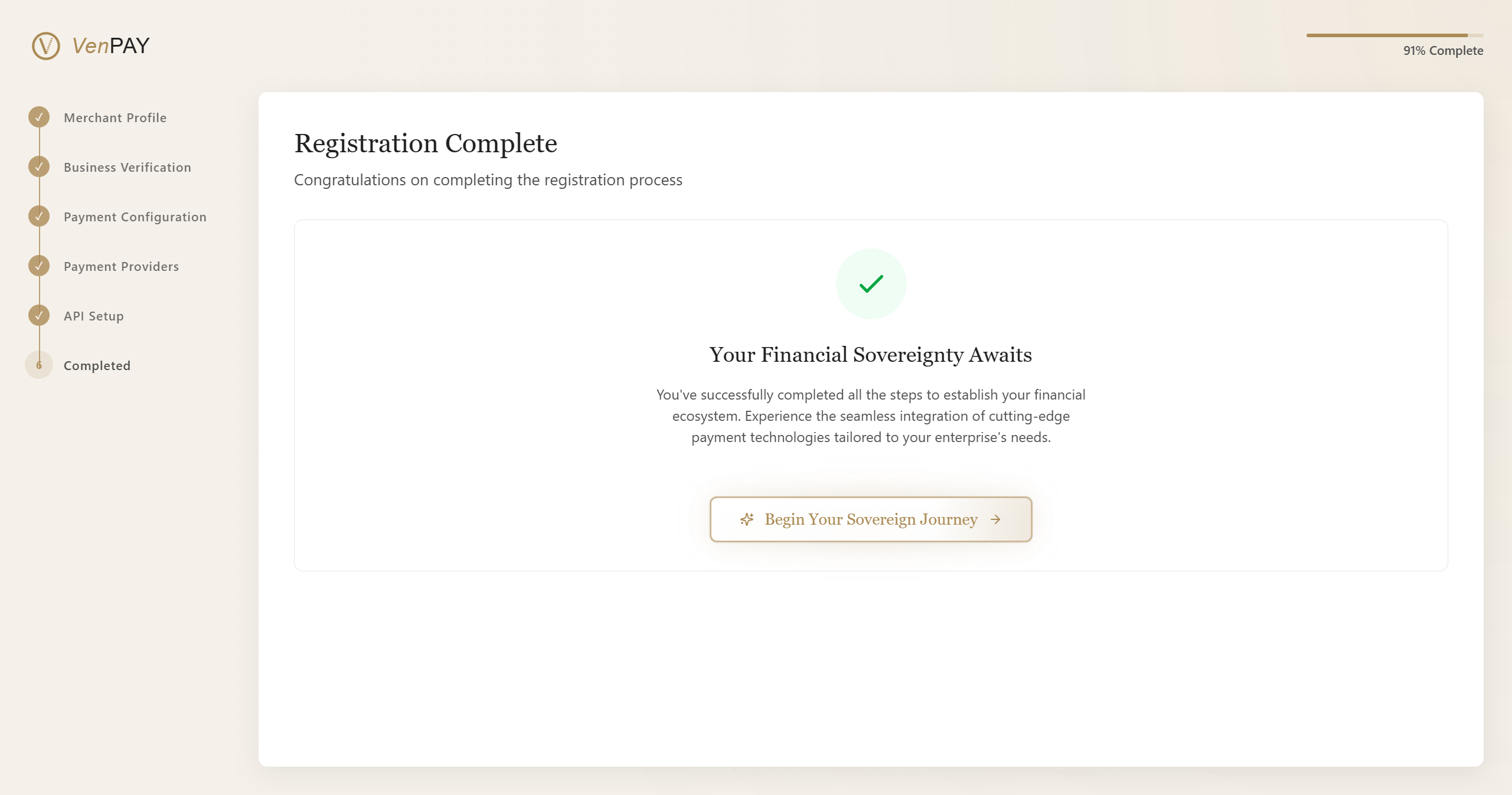

🎉 Registration Complete

🏁 Congratulations on Completing the Registration Process

🌍 Your Financial Sovereignty Awaits

You've successfully completed all the steps to establish your financial ecosystem. Experience the seamless integration of cutting-edge payment technologies tailored to your enterprise's needs.

📘 You already have a completed merchant setup.

👉 Please access your Dashboard to continue your journey.

Welcome to a new era of financial control and independence

💼 What’s Next?

- Explore your merchant dashboard

- Set up recurring payments or subscriptions

- Monitor transactions in real time

- Configure additional merchants or payment methods